Your credit report plays a vital role in your financial life. It documents your history of borrowing money and making payments over time.

Lenders, landlords, insurance companies, and even some employers review credit reports to help determine your creditworthiness and reliability.

That’s why it’s so important to understand what a credit report is, what goes into it, and how you can take control of this record to build and maintain your credit health. This comprehensive guide will equip you with the knowledge to master your credit report.

Why Understanding Your Credit Report Matters

Your credit report contains detailed information about your existing loans and credit accounts. It shows whether you make payments on time, carry high balances, or have accounts in collections.

This gives lenders insight into how responsibly you have managed debt in the past, which allows them to predict how likely you are to repay any new debts.

Having a long history of on-time payments and low credit utilization leads to better loan terms and interest rates. But your credit report isn’t only important when applying for financing.

Many landlords require credit checks on rental applications. Car insurance companies may offer discounts for good credit. Employers sometimes review credit reports to assess an applicant’s trustworthiness.

In short, good credit saves you money and opens up opportunities. That’s why it’s so valuable to understand and monitor your own credit report.

What Is a Credit Report?

A credit report is a record of your credit history compiled by one of the three major credit bureaus — Equifax, Experian, and TransUnion. These bureaus gather information about your existing loans, credit cards, and other lines of credit.

Your report details the types of accounts you have, when they were opened, your credit limits and balances, and your monthly payment history. It also includes any credit inquiries made by lenders, public records, and other financial information.

This data comes primarily from banks, credit unions, credit card issuers, and other lenders that you have borrowed money from in the past. They routinely provide updated details on your accounts to the credit bureaus.

How to Access Your Credit Reports

The Fair Credit Reporting Act guarantees that you can request a free copy of your credit report from each of the three credit bureaus once per year. You can obtain these through:

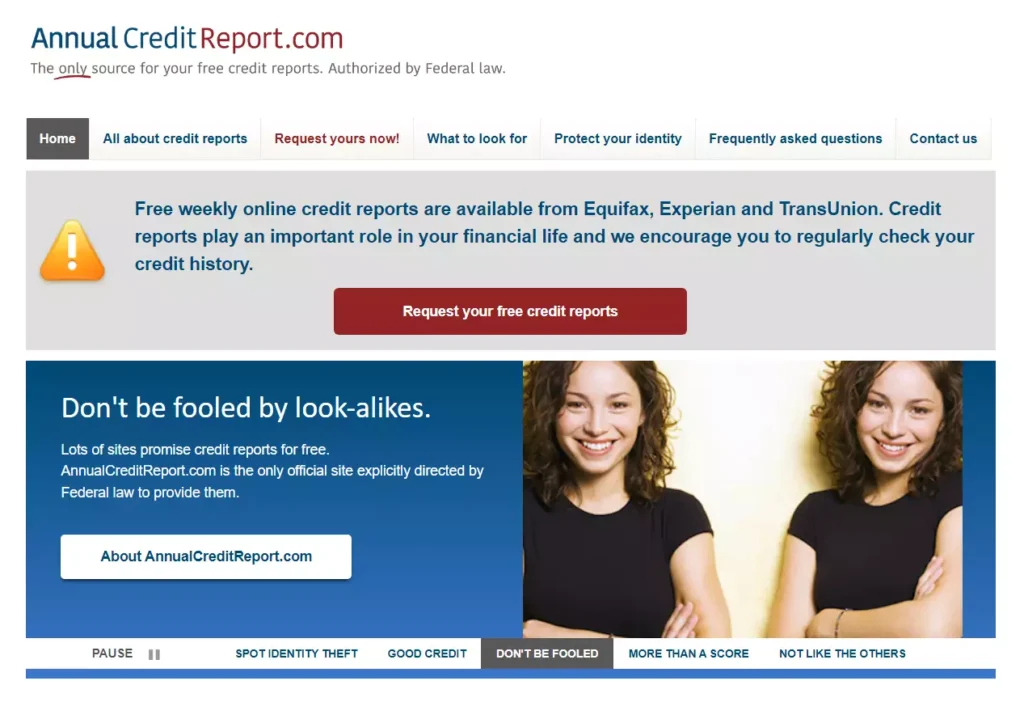

AnnualCreditReport.com

This official website set up by the three credit bureaus allows you to request free annual reports. You can access all three at once or check them separately whenever it’s convenient. Reports are available for online viewing as soon as you finish requesting them. If you mail in a request form instead, delivery takes about 15 days.

Calling 1-877-322-8228

To request reports by phone, call the Annual Credit Report hotline. Like the website, you can choose to receive all three reports at once or space them out over the year. After identity verification, your reports will be processed and mailed to you within 15 days. An audio version is also available for the visually impaired.

Mailing a Request Form

If you prefer, download the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Be sure to include identification documents as specified. Processing takes about 15 days from receipt of your request. You might also qualify for additional free reports if you have experienced identity theft, fraud, or denial of credit within the past year.

Understanding the Components of Your Credit Report

Credit reports are organized into sections listing identifying information, detailed account history, credit inquiries, and public records. Here is what you can expect to find in each one:

Personal Information

This includes your full legal name, any aliases you use, current and previous addresses, birth date, and Social Security Number. Some reports also list phone numbers and employers.

Credit Accounts

This section shows all your existing and recently closed credit accounts. For each account, you’ll see the date opened, type of credit (revolving, installment loan, etc.), credit limit or original loan amount, and the current balance.

The monthly payment history highlights any late payments and how long ago they occurred. Accounts in good standing show as “paid as agreed” or similar language.

Credit Inquiries

Whenever a lender checks your credit report, it generates an inquiry. These are either “soft inquiries” from checking your own credit or pre-qualified credit offers, or “hard inquiries” from applications for new credit.

Too many hard inquiries in a short timeframe can negatively impact your credit score.

Public Records and Collections

Bankruptcies, foreclosures, tax liens, civil judgments, and unpaid debts sent to collections appear here along with dates and details. Negative public records can severely damage credit scores.

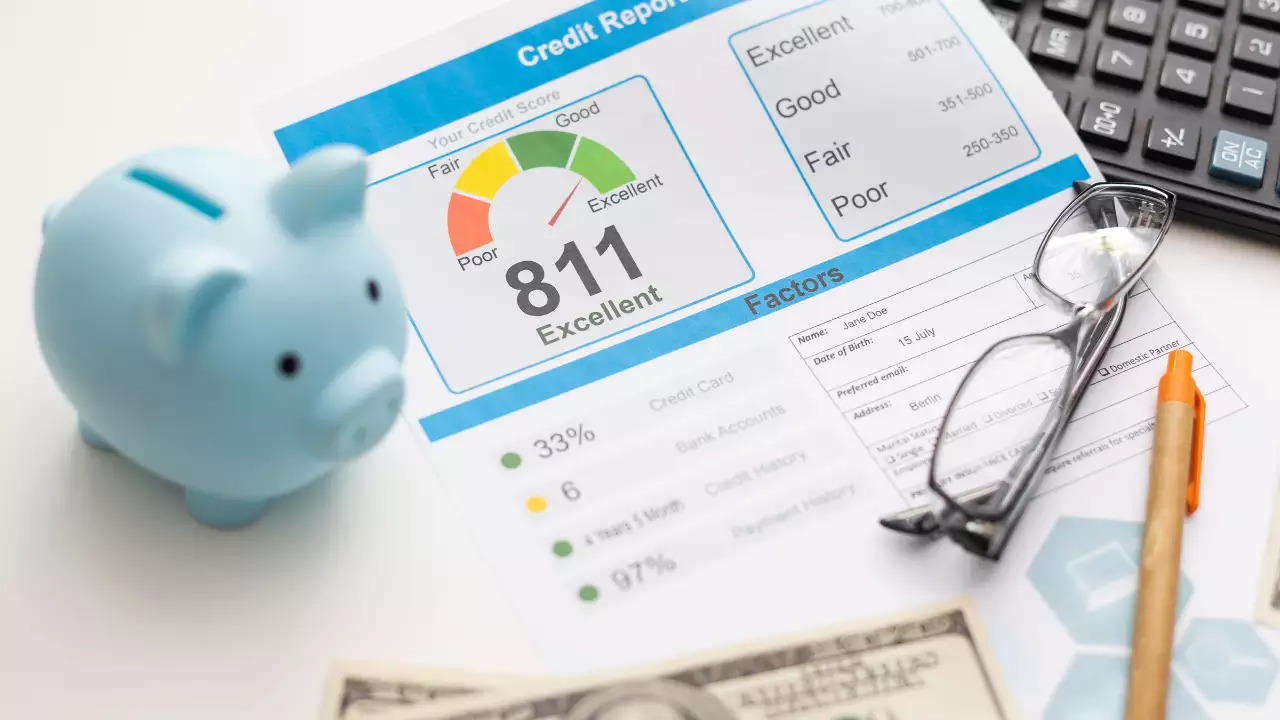

Why Your Credit Score Matters?

In addition to the detailed history in your credit reports, lenders consider your credit score when making decisions. This three-digit number summarizes your creditworthiness based on five main factors:

- Payment history – Are payments made on time?

- Credit utilization – What percentage of available credit is in use?

- Credit age – How long have accounts been open?

- Credit mix – What types of credit are maintained?

- New credit – How many new accounts have opened recently?

Many scoring models exist, but FICO and VantageScore are the most common. Scores range from 300 to 850, with 700+ generally considered good credit. The higher your credit score, the better interest rates and loan terms you can qualify for. Monitoring your score helps you measure credit health.

How to Read and Understand Your Credit Report

Learning to decode the information in your credit report takes some practice. But with time, you will know right away how to identify useful details and spot any suspicious activity.

Carefully review your personal details first. Verify that your identifying information is accurate and no unfamiliar accounts appear under your name. Then examine each credit account listing:

- Open date – Accounts more than a few years old signal an established credit history.

- High balance – This shows your highest balance over time, which reflects your credit utilization.

- Payment history – On-time payments maintain good standing. Any lateness could impact your scores.

- Status – Closed accounts in good standing still contribute to credit history.

Also note any credit inquiries from the past two years, as these can temporarily ding your credit score after too many accumulate. Take time to dispute any unfamiliar accounts or those with incorrect details to protect your credit standing going forward. This can be done directly through each credit bureau’s website.

The Impact of Credit Reports on Your Financial Life

Since credit reports provide the data used to determine those all-important credit scores that lenders rely on, maintaining a healthy credit history provides many benefits:

- Easier loan approvals – With good credit, you can qualify for the best loan terms from credit cards to auto financing and mortgages.

- Lower interest rates – Excellent credit means paying less interest over the life of installment loans and credit accounts.

- Increased buying power – Available credit allows you to finance large purchases and consolidate higher-interest debts.

But poor credit resulting from late payments, high balances, and collections can negatively impact your finances:

- Loan denial – Bad credit often means you don’t qualify for financing needed to buy or refinance a home, car, or pay for education.

- Higher interest rates – Poor credit history requires accepting whatever loan terms lenders will extend, often with exorbitant rates.

- Higher insurance premiums – Auto and home insurers charge more to cover perceived risks.

- Barriers to employment – Some employers check credit reports and may see poor credit as a red flag on applications.

- Difficulty renting – Landlords often reject rental applicants with bad credit or unestablished credit histories.

As you can see, the information contained in your credit report affects much more than just borrowing money. That’s why it’s so important to understand and monitor your credit by checking your reports and scores regularly.

Tips for Maintaining Good Credit Health

Now that you understand the importance of your credit report and how lenders use it to evaluate your reliability and trustworthiness, here are some tips for keeping your credit score in good shape:

- Check credit reports annually – Review all three credit bureau reports to verify accuracy and check for fraud.

- Dispute errors immediately – Incorrect or outdated information can negatively impact your score.

- Pay all bills on time – Payment history is the biggest factor influencing credit scores.

- Keep balances low – High credit utilization on revolving accounts hurts your score.

- Limit hard inquiries – Too many applications for new credit make you seem risky.

- Maintain longtime accounts – Increasing the average age of credit accounts helps your score.

- Use credit responsibly – Handling credit accounts prudently demonstrates you can manage debt well over time.

Disputing Inaccurate Information

Despite safeguards in place to ensure accuracy, errors sometimes creep into credit reports – an account that isn’t yours, a late payment you didn’t actually miss, account details that don’t match your records.

If you spot any incorrect information while reviewing your credit report, you have the right to dispute it. Both federal law and the Fair Credit Reporting Act guarantee this. Each credit bureau has a standard process for submitting disputes.

Generally, you will need to:

- Identify the specific information to dispute – Note the account name, number, and type of error.

- Provide supporting documentation – Copies of account statements or payment records help make your case.

- Submit dispute to credit bureau – Disputes can be initiated through the credit bureau websites or by mail.

- Allow 30-90 days for investigation – The credit bureaus contact the data provider, research the claim, then send an updated report reflecting any changes.

Here is a list of common website links for disputing inaccuracies on credit reports:

- AnnualCreditReport.com (Free annual credit reports)

https://www.annualcreditreport.com - Equifax Dispute Website

https://www.equifax.com/personal/credit-report-services/credit-dispute/ - Experian Dispute Website

https://www.experian.com/disputes/main.html - TransUnion Dispute Website

https://www.transunion.com/credit-disputes/dispute-your-credit - Consumer Financial Protection Bureau (Information on disputing errors)

https://www.consumerfinance.gov/ask-cfpb/how-do-i-dispute-an-error-on-my-credit-report-en-314/

Persistence pays off when disputing credit report errors. If the first investigation doesn’t resolve the issues completely, you can request another review.

Where to Learn More

As you work on taking control of your credit report, many excellent consumer resources exist to provide further guidance and support:

- AnnualCreditReport.com offers additional articles and FAQs about obtaining your free reports, disputing errors, and avoiding credit report scams. Their state-specific pages also provide information for identity theft victims.

- USA.gov provides official consumer information about credit reports and protection laws as well as what to do if your identity gets stolen.

- The Consumer Financial Protection Bureau offers guides for getting your credit reports, correcting inaccuracies, understanding scores, and dealing with debt collectors.

- FICO articles explain in detail what your credit report includes, how scores get calculated from that data, and ways to build good credit.

As you can see, credit reports contain a wealth of valuable information that can empower your financial decisions when you know how to access it and interpret it accurately.

We hope this comprehensive guide better equips you to take control of your credit report and leverage it to build your best financial future.